A Market of Contrasts

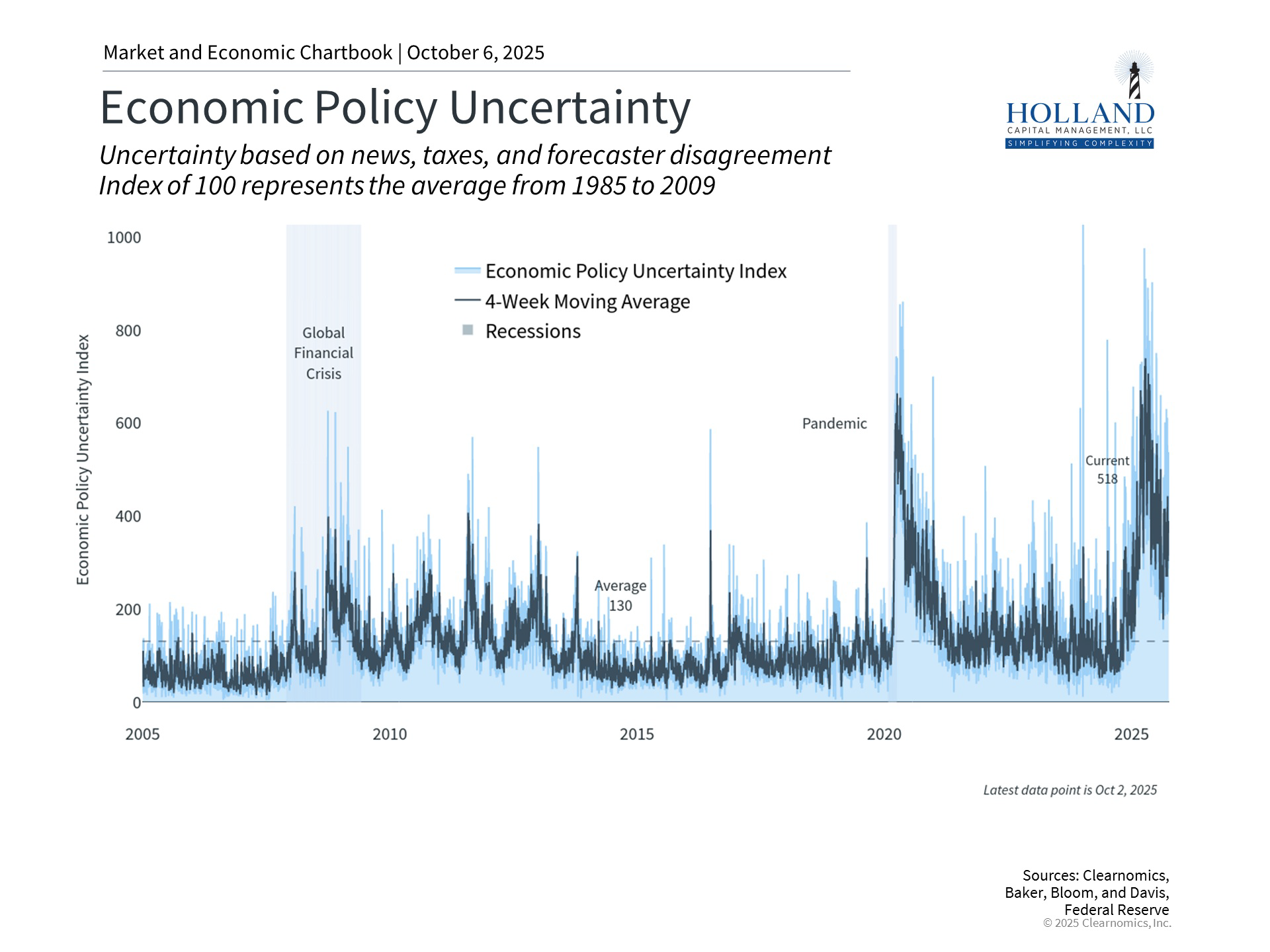

Volatility is a natural part of investing, but sharp swings have been especially pronounced in 2025. Earlier in the year, tariff-related selloffs caused uncomfortable short-term declines, only to be followed by powerful rebounds as investors regained confidence. These episodes can test patience, but they can also create entry points at better valuations.

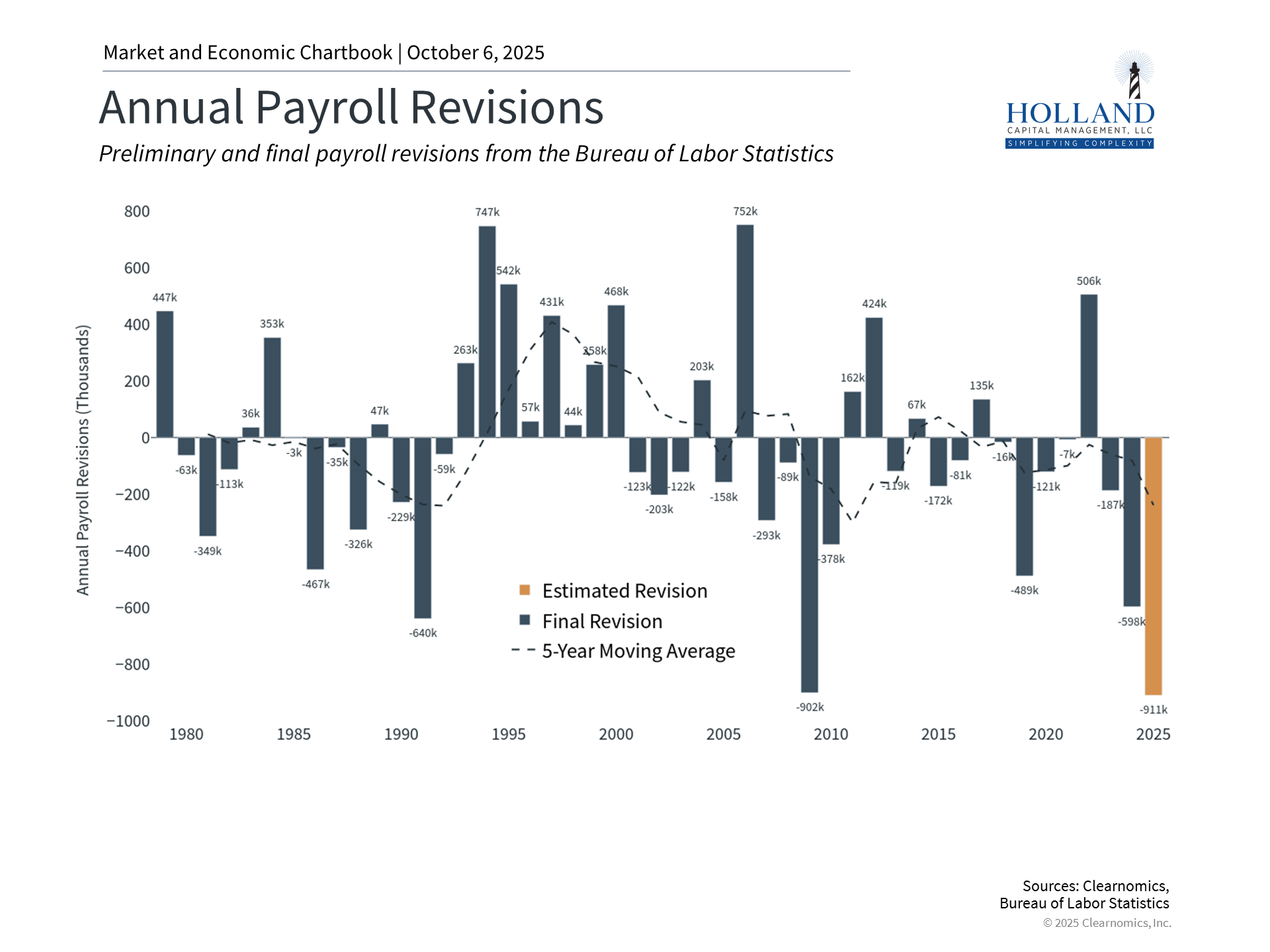

Now, as we enter the final quarter of 2025, investors face a market filled with conflicting signals. On one hand, equity indexes have surged to record levels, fueled by strong corporate earnings and enthusiasm for artificial intelligence. On the other hand, the labor market has shown real weakness, raising questions about the health of the broader economy and consumers’ ability to sustain growth. Inflation remains relatively contained, and GDP continues to expand, but the gap between strong market performance and weakening job creation is creating uncertainty for many investors.

This is precisely when having a clear retirement income plan becomes valuable. It allows investors to look beyond daily headlines and keep their long-term objectives in focus.

Discover the essential strategies to safeguard your wealth in volatile markets! Uncover expert insights and actionable tips in our latest E-book, How to Protect Your Wealth In Challenging Markets.

Discover the essentials to safeguard your wealth in volatile markets! Uncover expert insights and actionable tips in our latest E-book

How to Protect Your Wealth in Challenging Markets

Key Market and Economic Drivers in Q3

Equity Performance

Impressive gains across major equity benchmarks marked the third quarter of 2025:

- S&P 500: +7.8% in Q3; +13.7% YTD

- Nasdaq: +11.2% in Q3; +17.3% YTD

- Dow Jones Industrial Average: +5.2% in Q3; +9.1% YTD

All three reached new all-time highs in September, underscoring investor confidence despite mixed economic data. Technology shares and the so-called “Magnificent 7” stocks continued to lead markets higher, climbing more than 60% from their lows earlier in the year.

Periods of rapid growth often tempt investors to chase performance. Still, disciplined strategies grounded in fundamentals, like those applied by a fiduciary, fee-only advisory firm, focus instead on sustainable return drivers.

Fixed Income Markets

Bonds also delivered gains. The Bloomberg U.S. Aggregate Bond Index rose 2.0% for the quarter and is now up 6.1% for the year. The 10-year Treasury yield ended Q3 at 4.15%, after briefly dipping to 4.02%.

These moves reflect a shift in expectations around Federal Reserve policy, with investors now anticipating further easing. Lower rates typically support bond prices and can help stabilize portfolios when equity markets are volatile.

Valuations: Elevated but Uneven

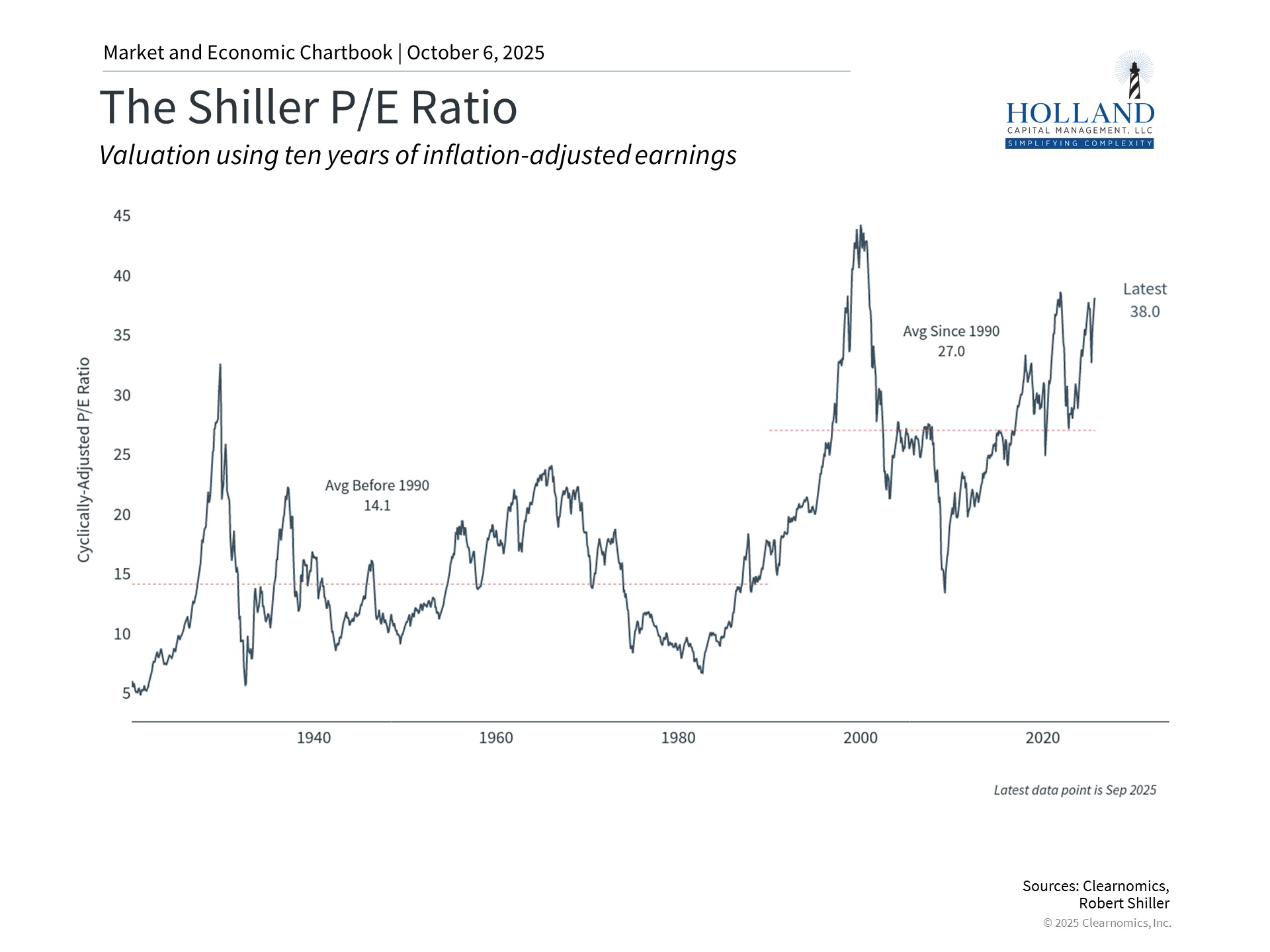

One of the most important considerations for long-term investors is valuation. The Shiller P/E ratio for the S&P 500 now stands at 38 times, far above its 35-year average of 27 times. This puts valuations at levels last seen during the late 1990s dot-com era.

High valuations reflect optimism, but they also suggest that some parts of the market may be priced for perfection. While large-cap growth stocks look expensive, other areas, including small-cap, value, and international equities, still offer more attractive entry points.

This is where selectivity matters. Rather than blanket diversification, a fiduciary advisor (https://hollandcapitalgroup.com/why-were-different/) can help identify opportunities in undervalued segments while avoiding areas that carry unnecessary risk.

The Federal Reserve: Balancing Growth and Employment

At its September 2025 meeting, the Federal Reserve reduced the federal funds rate by 0.25 percentage points, bringing the target range to 4.00–4.25 percent. This marked a return to easing after the central bank had held rates steady for much of the year.

What makes this cycle unusual is that the Fed is cutting even as the economy continues to grow. Historically, rate cuts have come in response to recessions or financial crises. Today, they reflect the Fed’s attempt to normalize policy after the rapid tightening cycle of 2022 and 2023, while also responding to a softer labor market.

For clients, this reinforces why we build plans that are flexible enough to handle both rising and falling rate environments. A personalized approach, rather than a one-size-fits-all allocation, helps keep portfolios aligned with long-term goals, regardless of the Fed’s next move.

Volatility and Policy Uncertainty

Measures of market volatility eased in the third quarter:

- VIX (stock market volatility): 16.3, below its long-term average of 18

- MOVE (bond market volatility): 78, below its long-term average of 87

This relative calm stands in contrast to the turbulence of recent years, which has included inflation spikes, trade tensions, political brinkmanship in Washington, and geopolitical shocks. However, history shows that quiet markets can quickly turn turbulent.

The ongoing government shutdown, evolving tariff policies, and global conflicts remain potential catalysts for renewed volatility. Investors who have clarity around their strategy are better positioned to weather unexpected events. For many, that begins with working alongside a fiduciary, fee-based advisor who can interpret uncertainty and keep portfolios aligned with financial objectives.

The Bottom Line

As Q4 2025 begins, investors are navigating record highs alongside signs of economic weakness. This is a market environment that rewards discipline and discernment.

While some advisors default to “owning everything” as a hedge against uncertainty, we take a different view. Not all asset classes and sectors are created equal, and not every investment is worth your capital simply for the sake of diversification. Elevated valuations in specific segments of the market contrast with attractive opportunities elsewhere, making selectivity a crucial advantage.

At Holland Capital Management, our focus is on building intentional portfolios that are rooted in fundamentals, managed with care, and aligned with long-term outcomes. That means carefully weighing where valuations make sense, where risks are mispriced, and where durable growth drivers can be found.

In an environment of conflicting signals, investors do not benefit from spreading capital indiscriminately. They benefit from a thoughtful, fiduciary approach that adapts to evolving markets while maintaining a focus on long-term goals.

Take charge of your financial future! Schedule a free consultation with Holland Capital Management now.

Getting Started with Holland Capital Management

Take charge of your financial future! Schedule a free consultation with Holland Capital Management now.

Frequently Asked Questions

Why are markets near record highs if the labor market is weakening?

Markets are forward-looking. Strong corporate earnings and enthusiasm for innovation have supported equity prices even as job creation slows. This disconnect highlights the importance of selectivity, as not all sectors or companies are equally well-positioned for long-term growth.

What does the Federal Reserve’s recent rate cut mean for investors?

The Fed cut interest rates in September for the first time since early 2023. Lower rates often provide support for both stocks and bonds, but they are not a guarantee of future returns. The more critical factor is how portfolios are structured to adapt to changing interest rate environments.

Are valuations stretched across the entire market?

Not necessarily. Large-cap growth stocks look expensive, with valuations above historical norms, but areas such as small caps, value equities, and international markets appear more attractive. Investors benefit from an intentional approach that carefully weighs these differences.

How does Holland Capital Management approach this environment?

We do not believe in broad, one-size-fits-all diversification. Instead, we build intentional portfolios rooted in fundamentals, valuation discipline, and risk management. The goal is to capture opportunities where they are justified while protecting clients from unnecessary risk.