Key Highlights

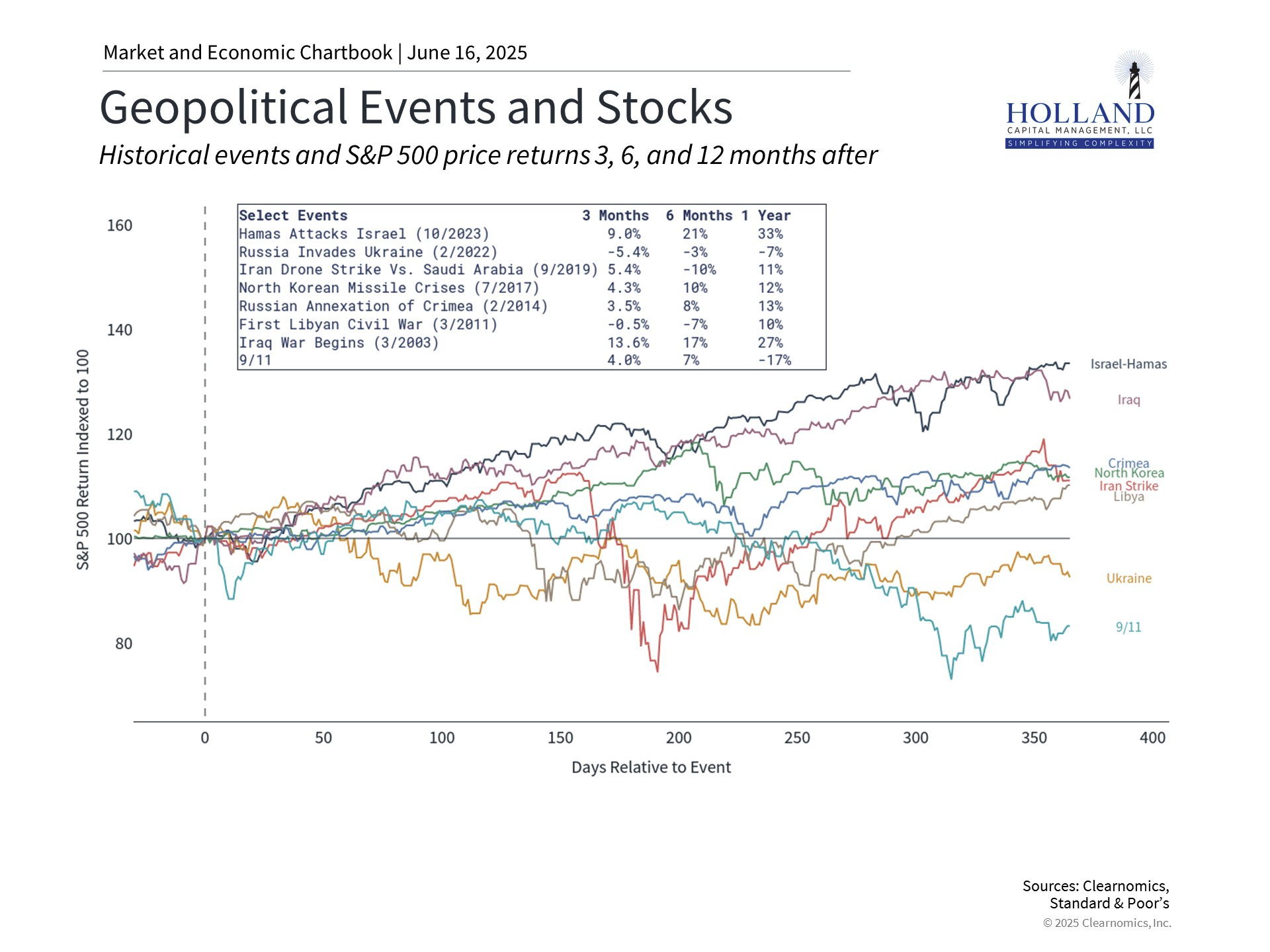

- The Middle East conflict is creating short-term volatility, but history shows markets tend to recover quickly.

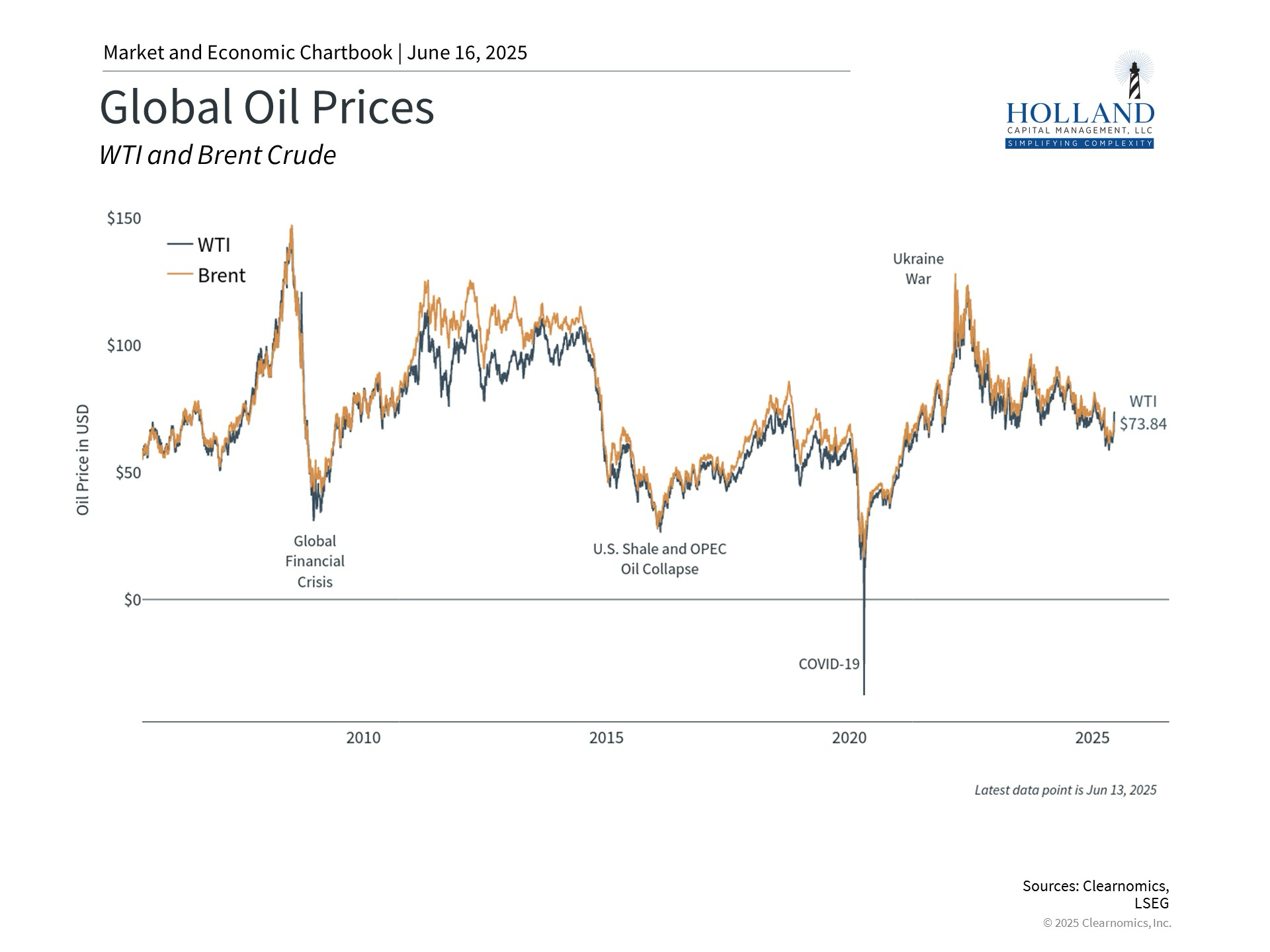

- Energy prices are the first to react—Brent crude spiked but remains within a manageable range.

- U.S. energy independence helps buffer market impact from global supply disruptions.

- Long-term portfolio discipline is more important than reacting to daily headlines.

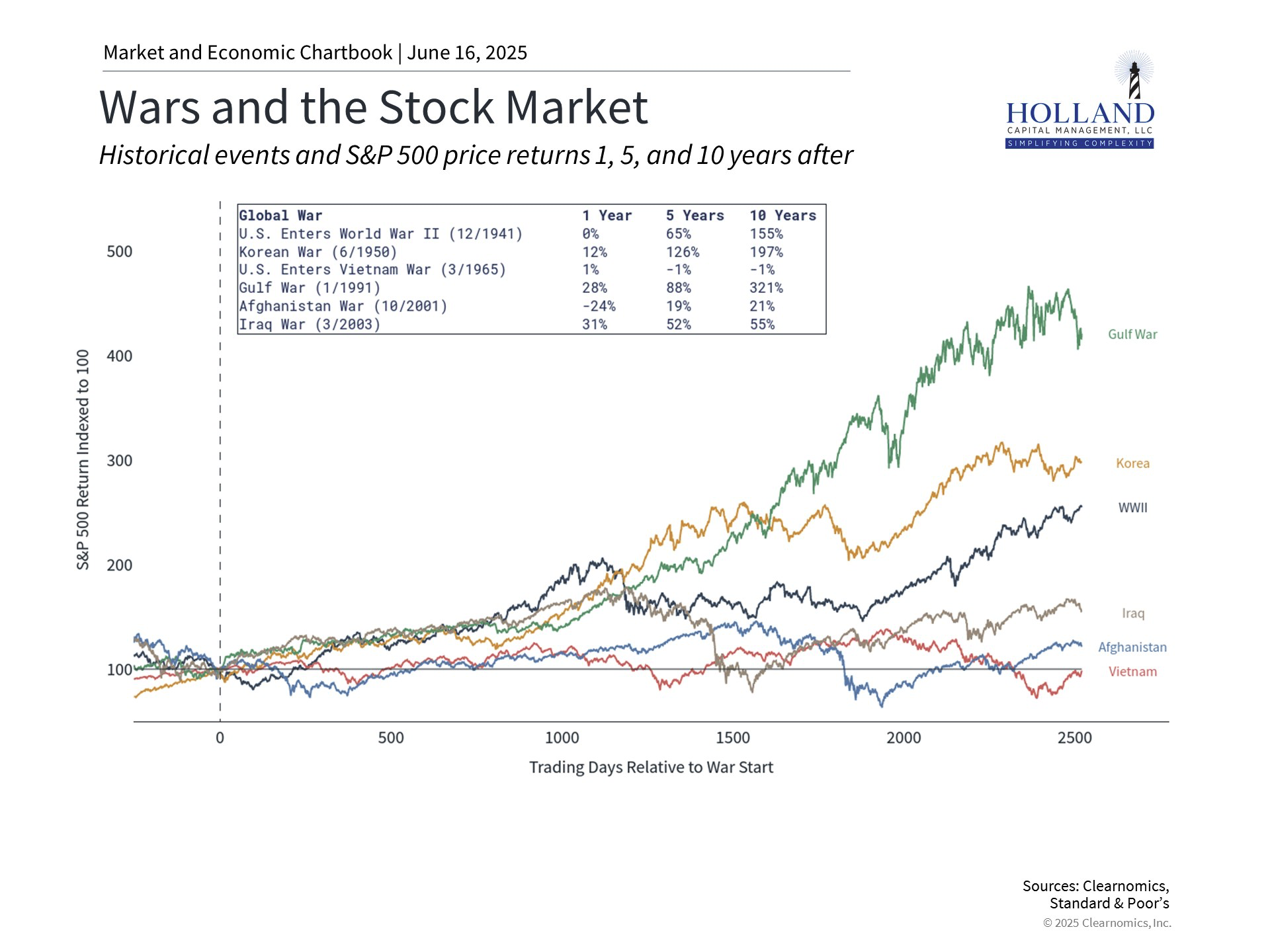

- Geopolitical risks are real, but economic fundamentals still drive market outcomes.

Discover the essentials to safeguard your wealth in volatile markets! Uncover expert insights and actionable tips in our latest E-book

How to Protect Your Wealth in Challenging Markets

The Middle East Conflict: What It Means for Your Portfolio

As headlines swirl with news of renewed conflict in the Middle East, investors are understandably on edge. Israeli airstrikes on Iranian nuclear and military targets, followed by Iranian retaliatory attacks, have led to heightened tensions across the region. While reports hint that Iran may be open to de-escalation and talks, uncertainty remains.

From a humanitarian standpoint, the cost of war is immeasurable. As fiduciaries, however, we also must help clients navigate how events like this can ripple through markets. The central question we’re hearing is this: Should I be doing something different with my portfolio right now?

The short answer is: not necessarily.

Short-Term Shocks, Long-Term Lessons

Markets are inherently reactive, and geopolitical shocks almost always lead to short-term volatility. But when you zoom out, history has consistently shown that most regional conflicts, including those in the Middle East, rarely alter the long-term trajectory of the market.

We’ve seen this play out before: Russia’s invasion of Ukraine, attacks on Saudi oil infrastructure, the Gulf War. While each of these events caused short-term fear, none fundamentally changed the broader investment picture. The market digested the news, re-priced risk, and moved on, often within weeks or months.

The lesson? Reacting emotionally to headlines can do more harm than good. Disciplined investors stay grounded in fundamentals.

Energy Prices Are the First to React

Oil prices tend to be the first economic domino to fall when war breaks out in oil-producing regions. Brent crude spiked above $74 after the first strikes but quickly retreated as hopes for de-escalation emerged. Prices remain well below 2022 peaks and within the range seen over the past few years.

It’s worth noting that while oil remains a key economic input, the U.S. is better positioned today than in prior decades. Domestic oil production has soared—over 13.5 million barrels per day—making the U.S. the largest producer of both oil and natural gas. This energy independence offers a cushion that helps insulate our economy and markets.

It’s the Business Cycle That Matters Most

Looking back, markets have ultimately been shaped more by economic fundamentals than by war headlines.

- World War II sparked a manufacturing boom and transformed the labor market.

- The Gulf War coincided with the early days of the tech revolution.

- The Vietnam War unfolded during a period of stagflation and economic malaise.

Geopolitical tension may alter the mood, but economic conditions, such as growth, inflation, and interest rates, continue to drive market outcomes.

The Bottom Line for Investors

We don’t downplay the seriousness of these events. But we’ve seen this movie before: conflict causes fear, markets wobble, and investors wonder what to do.

Our advice remains the same:

Stay the course. Stick to your plan. Don’t let headlines derail long-term thinking.

As always, if you have questions about your financial plan or want a second opinion on your current strategy, we’re here to help.

Getting Started with Holland Capital Management

Take charge of your financial future! Schedule a free consultation with Holland Capital Management now.