At Holland Capital Management, we recognize that few financial decisions feel as meaningful or complex as college planning. Thoughtful education planning helps families manage today’s rising costs and secures tomorrow’s opportunities. Integrating education funding into your overall financial plan is essential, whether looking for wealth planning services, retirement income planning, or private wealth management expertise.

The Lasting Value of a College Education

Benjamin Franklin once said, “An investment in knowledge pays the best interest.” That sentiment remains true today. Despite increasing tuition costs, higher education provides significant long-term financial benefits. Comprehensive financial planning, including college funding strategies, can enhance these outcomes and protect your family’s broader wealth goals.

Why College Costs Keep Rising

Over the past four decades, college costs have consistently outpaced general inflation. According to the College Board, the average total cost for the 2024–2025 academic year reached $58,600 for private institutions and $24,920 for public universities (in-state, including room and board). Independent wealth management and portfolio management services can help families navigate these rising expenses through structured saving and investment strategies.

Is Higher Education Still Worth the Investment?

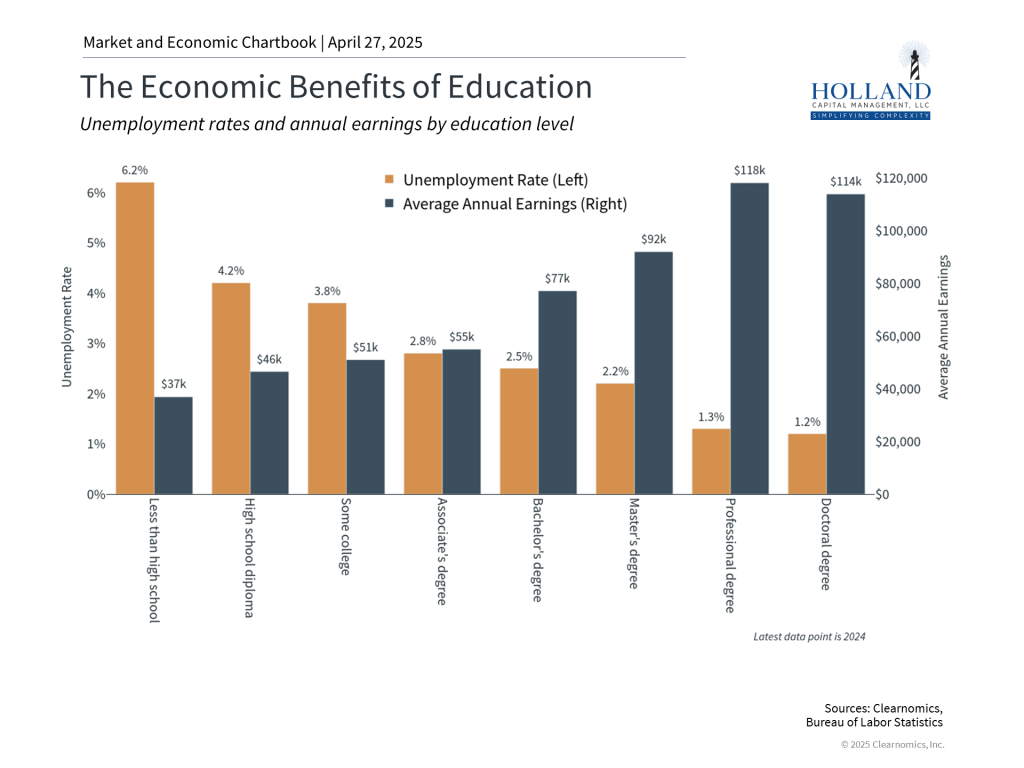

While every family’s situation is unique, higher education remains a valuable investment. Recent Bureau of Labor Statistics data shows that bachelor’s degree holders enjoy significantly higher earnings and lower unemployment rates than high school graduates. Engaging a fiduciary financial planner near you or a fee-only financial planner can help you weigh the costs against the potential lifetime returns.

The Impact of Your Major and School Choice

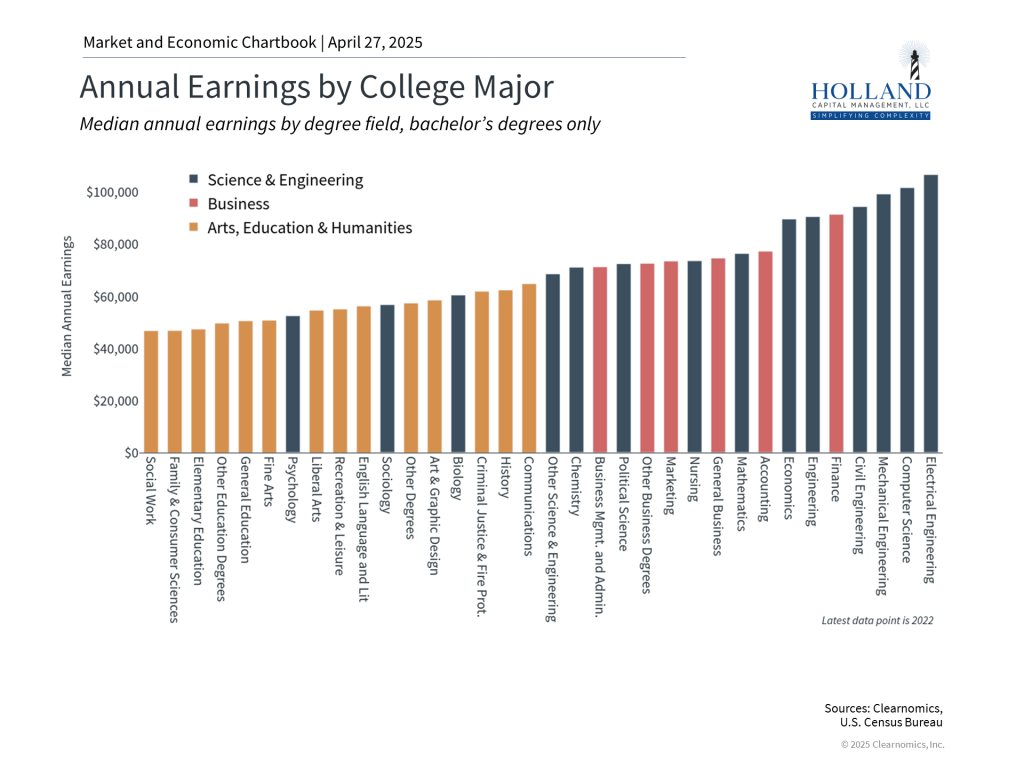

Field of study and school selection can dramatically influence the financial return on your college investment. STEM degrees typically yield higher earnings, while other fields may require more thoughtful financial planning. Holland Capital Management offers independent financial advisory services that help families make informed, strategic decisions aligned with their broader investment management service needs.

Saving Strategies to Support Your Education Plan

Effective college planning involves the right combination of tools and timing. 529 Plans, UGMA/UTMA accounts, direct tuition payments, and education trusts each offer unique advantages.

Integrating College Planning into Your Financial Future

At Holland Capital Management, we specialize in simplifying complexity across all aspects of financial planning. Our fiduciary-first approach ensures that your education and retirement strategies work together seamlessly.

From high-net-worth wealth management to retirement income planning, we provide transparent, outcome-driven advice tailored to your goals. If you’re ready to find a financial advisor or hire a financial planner who puts your interests first, Holland Capital Management is here to help.

The Bottom Line on College Planning

College planning is a significant financial decision that deserves the same careful attention as retirement planning or estate management. Working with a trusted fiduciary financial advisor can balance today’s education costs with tomorrow’s opportunities, building a stronger financial future for your family.